31+ Mortgage loan payoff calculator

Click the View Report button to see a complete amortization payment schedule and how much you can save on your mortgage. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

G201504061231515332622 Jpg

You can make extra payments each month or set a desire payoff year.

. Loan Calculator With Extra Payment. Loan Payoff Calculator to learn how much you can save in interest payments when you payoff your loan early. This mortgage payoff calculator helps you find out.

Click the View Report button to see a complete amortization payment schedule. A mortgage usually includes the following key components. Use this free tool to figure your monthly payments on a 10-year FRM for a given loan amount.

31 Home mortgage payoff calculator. The 30-year jumbo mortgage rate had a 52-week low of 519 and a 52-week high of 607. Are you thinking of buying a home.

Mortgage repayment shortened by 3 years and 1 month. Once you have punched in the numbers you will be able to view your newly amortized schedule. You have the.

Thats a saving of 4402. Please note the early mortgage payoff calculator does not take into account other fees such as tax and insurance as well as private mortgage insurance if your down payment is less than. August 31 2022Rates Rise Again.

If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay 134205 each month in principal and interest alone. How much interest can you save by increasing your mortgage payment. Your monthly payment would be 29588 meaning that your total interest comes to 1325840.

Current Monthly Payment Extra Monthly Payment. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Loan pay-off date 30547814 Total Interest Paid 20000 Monthly Tax Paid 7200000 Total Tax Paid 8333 Monthly Home Insurance 3000000 Total Home Insurance 2424927 Annual.

Get a quick and clear picture of what it will take to pay off your mortgage with this accessible mortgage loan calculator template. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Pin On Family Fun Food Frugality Group Board.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. You borrow 40000 with an interest rate of 4. The maximum loan amount one can borrow normally correlates with.

Ad Increasing Mortgage Payments Could Help You Save on Interest. This mortgage payoff calculator helps you find out. Learn more about specific loan type rates.

Mortgage Balance Interest Rate. The mortgage payoff calculator helps you find out. Loan calculator with extra payments is used to how early you can payoff your loan with additional payments each period.

A mortgage payoff calculator can help you. This will allow you to begin budgeting on how to incorporate increased payments into your monthly or yearly payments. Loan calculator with extra payments is used to how early you can payoff your loan with additional payments each period.

In a mortgage this amounts to the purchase price minus any down payment. Using the Mortgage Payoff. You will pay 23313389 in interest over the course of the loan.

The 30-year jumbo mortgage rate had a 52-week low of. Fill in the inputs below on our mortgage payment calculator to see how you can save thousands of dollars by paying off your loan early. Please enter how much you want to spend each month an interest rate and a loan amount and this calculator will tell you how long it will take you to pay off the loan.

Found on the Set Dates or XPmts tab. Beginning Balance of Loan Minimum Monthly payment Maximum Monthly payment APR fixed loan Click Here to Get Matched With a Lender. The APR is normally higher than the.

The loan is for 15 years. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster. Current Mortgage Interest Rates.

The first version of the mortgage calculator provides detailed payment and mortgage information with an mortgage amortization schedule. Please note that the interest rate is different from the Annual Percentage Rate APR which includes other expenses such as mortgage insurance and the origination fee and or point s which were paid when the mortgage was first originated. Fill in the inputs below on our mortgage payment calculator to see how you can save thousands of dollars by paying off your loan early.

The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week. But paying an extra 100 a month could mean you repay your loan a whole five years earlier and only pay 885567 interest. Early Loan Payoff Calculator.

Loan amountthe amount borrowed from a lender or bank. Current 10-year home loan rates are shown beneath the calculator. These are also the basic components of a mortgage calculator.

The annual interest rate used to calculate your monthly payment. Mortgage Payoff Calculator How much interest can be saved by increasing your mortgage. This Excel loan calculator template makes it.

Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

Pin On Savings Side Gigs Financial Success

Img004 Jpg

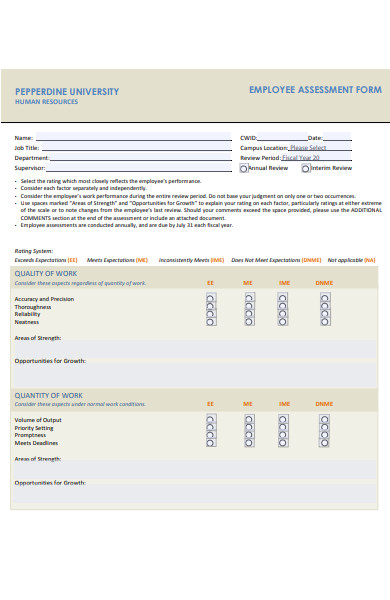

Free 31 Job Assessment Forms In Pdf Ms Word

31 Inspirational Quotes For First Year Teachers Great Teacher Quote Quotes Teaching Quotes Clas Education Quotes Teacher Quotes Inspirational Teaching Quotes

31 Commonly Missed Tax Deductions For Stylists Barbers And Beauty Professionals The Handy Tax Guy

Free 31 Chart Templates In Ms Excel

2

2

Img008 Jpg

2

Pin On Family Fun Food Frugality Group Board

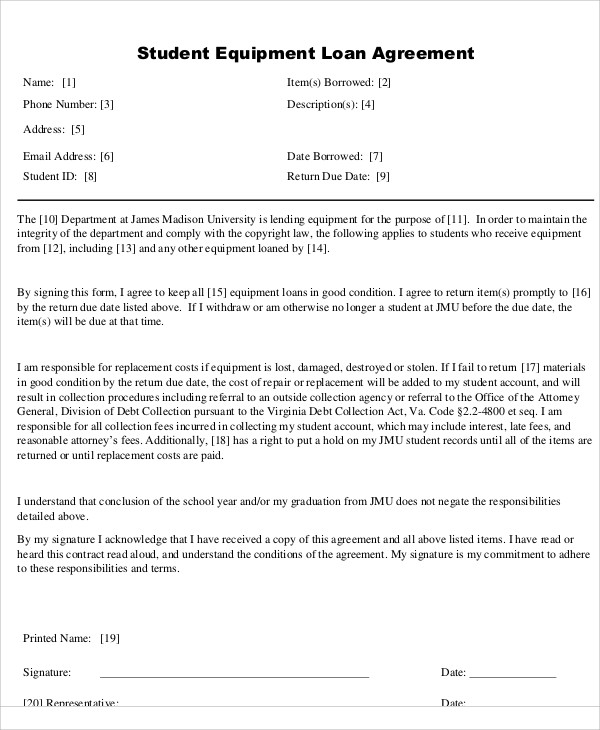

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

Prosper 424b3 20160630 Htm

31 Ways To Earn Money From Home In 2022 Oh She Creates

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

31 Free Personal Finance Homeschool Resources

How To Start A Budget Journey To Financial Freedom Budgeting Budgeting Tips Budgeting System